MF CCP

Full STP Clearing governance

As a response to a newly complex and dynamic set of risks, regulators and the industry have been establishing over the recent years a clearing-houses and central-counterparties based system for derivatives trading.

Full STP Clearing governance

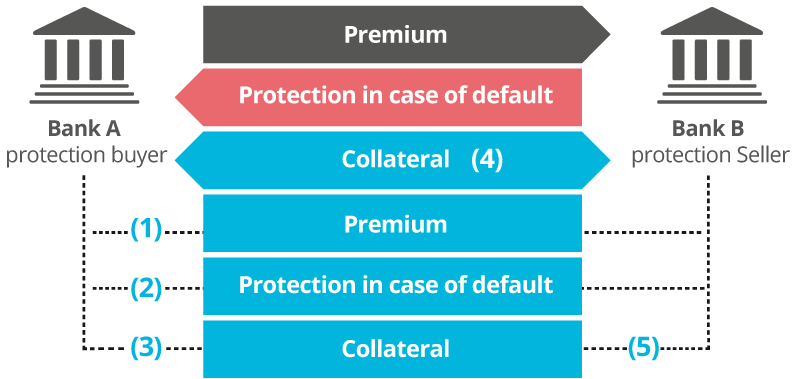

(1) Over-the-counter clearing through CCP

(2) Extension of central trade information for non CCP trades

(3) Overall acceleration of electronic trade processing to t+0 standard

(4) Daily standardized reconciliation of collateralized portfolio

(5) Electronic and automated processing of trade life-cycle events

As this structural change is definitely enabling market participants to trade with increased confidence on full settlement of contracts, new operational and infrastructural requirements have been emerging, once again in the direction of flexible internal processes and supporting systems.

In a landscape characterized by fragmented technology, multiple data repositories, overwhelming regulatory oversight and changing client requirements, MF CCP provides an advanced STP, a comprehensive trade repository, plus cross-asset collateral and margin management for both OTC and exchange-traded derivatives.

In a landscape characterized by fragmented technology, multiple data repositories, overwhelming regulatory oversight and changing client requirements, MF CCP provides an advanced STP, a comprehensive trade repository, plus cross-asset collateral and margin management for both OTC and exchange-traded derivatives.